XRP Price Prediction: Analyzing the Path to $10+ Amid Institutional Surge

#XRP

- Technical consolidation above key moving average support at $2.9562

- Strong institutional momentum with 762% ETF inflow surge and new financial products

- Analyst predictions ranging from $10 to $30 by 2026 based on growing adoption

XRP Price Prediction

XRP Technical Analysis: Consolidation Above Key Support

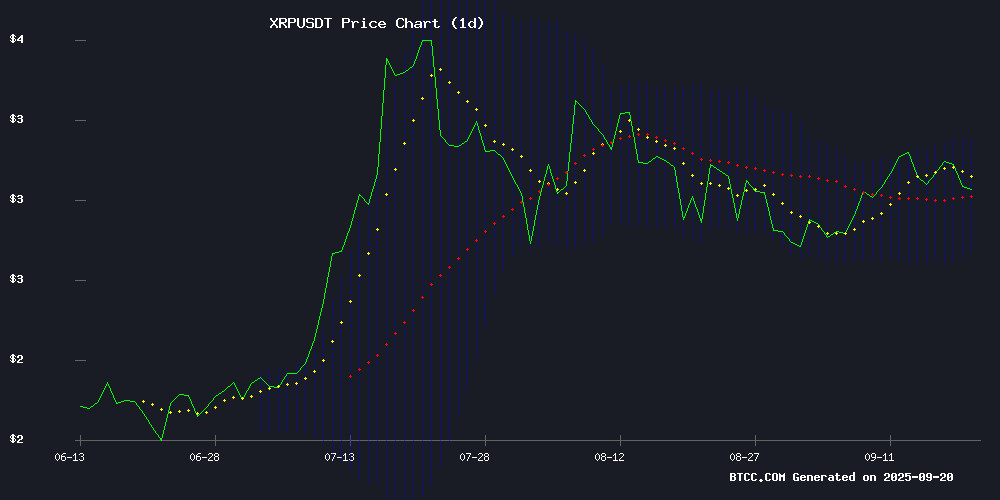

XRP is currently trading at $2.9877, slightly above its 20-day moving average of $2.9562, indicating potential support holding. The MACD reading of -0.1339 | -0.0724 | -0.0615 shows bearish momentum but with decreasing negative divergence. Bollinger Bands position the price between $3.1738 (upper) and $2.7386 (lower), suggesting consolidation within a defined range. According to BTCC financial analyst Mia, 'The current technical setup shows XRP consolidating healthily above its 20-day MA, which could provide a springboard for the next upward MOVE if institutional inflows continue.'

Institutional Momentum Builds for XRP

Market sentiment for XRP appears overwhelmingly bullish as institutional interest reaches new heights. The successful XRP ETF launch on CBOE, recording a 762% surge in exchange inflows, combined with growing analyst predictions of $10+ price targets, creates a positive backdrop. BTCC financial analyst Mia notes, 'The combination of ETF success, institutional adoption through the first XRP-backed stablecoin, and strong analyst projections suggests the current consolidation may precede significant upward movement. However, investors should remain cautious of expected volatility around key decision points.'

Factors Influencing XRP's Price

XRP Price Projected to Reach $30 by 2026 as Institutional Interest Grows

XRP's price could surge to $30 by 2026, with some analysts even forecasting a test of $34. The bullish sentiment is driven by technical indicators showing a double bottom breakout pattern, accelerating institutional capital inflows, and increasing likelihood of a spot XRP ETF approval.

Beyond passive holding, Savvy Mining offers a dual-return model combining price appreciation with daily mining income. The platform provides XRP mining contracts, allowing investors to generate passive cash FLOW while maintaining token exposure.

Market observers note that convergence of these factors could replicate XRP's tenfold growth from previous bull cycles. The asset's potential is drawing comparisons to early-stage institutional adoption patterns seen in other major cryptocurrencies.

XRP ETF Speculation and XRP Tundra Presale Highlight Diverging Investor Strategies

Speculation around a potential XRP ETF continues to build, fueled by growing institutional demand and political tailwinds. Analysts cite former President Trump's earlier proposal to include XRP in a crypto reserve as a sign of widening acceptance. An ETF approval could unlock billions from pension funds and wealth managers, cementing XRP's position alongside Bitcoin and ethereum in regulated portfolios.

Meanwhile, retail investors are flocking to the XRP Tundra presale, drawn by its promise of immediate upside. The dual-token offering launches at $0.01 in Phase 1, with projected valuations of $2.50 for TUNDRA-S and $1.25 for TUNDRA-X at listing—a potential 2500% gain. This contrasts sharply with the gradual appreciation expected from ETF investments.

The market bifurcation reflects crypto's evolving landscape: institutional players pursue mainstream validation through ETFs, while agile investors chase asymmetric opportunities in presales. XRP Tundra's staking mechanisms and transparent governance aim to address the retail market's appetite for defined-risk, high-reward entry points.

Analysts Dismiss Market Cap Concerns, See XRP Hitting Double Digits

Cryptocurrency analyst XForceGlobal has challenged prevailing skepticism about XRP's price potential, dismissing market capitalization concerns as flawed reasoning. Technical analysis suggests the digital asset could first target $4-5 before potentially rallying toward $14 by 2026.

The analyst points to a 2024 triangle breakout pattern as evidence of sustained bullish momentum, a formation that historically precedes significant rallies in crypto markets. Current price action shows XRP maintaining key support levels despite recent volatility, providing a foundation for potential upward movement.

"Don't be fooled by those who say the price cannot rise to $10+", XForceGlobal stated, emphasizing that traditional market cap calculations may not apply to cryptocurrency valuations. The projection comes as technical indicators show XRP holding above critical support zones, with the $4 range identified as an initial target for new all-time highs.

Analyst Debunks Market Cap Concerns, Predicts XRP Surge to $10+

Crypto analyst XForceGlobal has dismissed arguments that XRP's market cap WOULD prevent its price from reaching $10 or higher. In a recent post on X (formerly Twitter), the analyst emphasized that such concerns are irrelevant, pointing to a bullish triangle breakout pattern that began in 2024 as a key driver for future gains.

According to the analyst's chart, XRP could initially rally to $4, setting a new all-time high, before surging over 200% to break $10 by 2026. The post warns investors against being misled by market cap calculations, framing the token's trajectory as inevitable given its technical setup.

Separately, analyst TradingShot reinforced the bullish case, noting XRP's resilience despite recent price declines. The dual perspectives suggest growing confidence in XRP's ability to defy conventional valuation metrics and enter double-digit territory.

Analyst Predicts 'Face-Melting' Rally for XRP, Drawing Parallels to 2017 Surge

XRP is poised for a potential parabolic rally, according to technical analyst EtherNasyonaL. The chartist notes striking similarities between current price action and the 2017 bull cycle that propelled Ripple's token to historic highs. A repeat performance could see XRP reach $5-$7 by 2025.

Market observers point to multiple catalysts, including resolution of Ripple's SEC lawsuit and growing institutional infrastructure. Spot XRP ETF applications awaiting SEC approval add further fuel to bullish sentiment, though regulatory hurdles remain.

The XRP Army has amplified these projections, with prominent community figures like Ripple Bull Winkle highlighting the token's improving fundamentals. Network partnerships and regulatory clarity are seen as key drivers for the next leg up.

3 Crypto Hacks Every Investor Should Know

In the crypto world, success hinges on strategy rather than luck. Savvy traders leverage dollar-cost averaging (DCA) to mitigate volatility and capitalize on market dips. By spreading purchases over time, investors avoid the pitfalls of timing the market and position themselves for long-term gains.

Utility-driven projects outlast HYPE cycles. Ripple's cross-border payment solutions exemplify enduring value, while the next wave of winners will emerge from initiatives solving real-world problems. Adoption, partnerships, and developer activity serve as key indicators of sustainable growth.

Emerging projects like MAGACOIN FINANCE are gaining traction as analysts identify potential opportunities for the coming year. A balanced approach combining proven strategies with early access to innovative developments may yield significant returns.

XRP Consolidates at $3 — Analysts Flag Ripple as a Hidden Gem Before ETF Decision

XRP holds steady at $3 as market participants await the next catalyst. ETF speculation intensifies, casting Ripple's native token in a new light. Analysts now position it as a long-term play amid growing institutional interest in blockchain-based payments.

Pantera Capital's Dan Morehead draws parallels between Ripple's ambitions to disrupt SWIFT and Bitcoin's role as digital gold. This dual narrative fuels demand across retail and institutional cohorts.

Technical analysts observe striking similarities between current price action and the 2017-2018 cycle. Galaxy, a prominent market commentator, suggests history may rhyme as regulatory clarity improves. The $3 level emerges as critical support—a springboard for potential upside should ETF approvals materialize.

First XRP-Backed Stablecoin Launches on Flare Network

Flare Network has introduced the first XRP-backed stablecoin, enabling holders to access liquidity without divesting their positions. The system employs a Collateralized Debt Position (CDP) model, allowing users to lock FXRP (wrapped XRP) or Flare’s native wFLR as collateral to mint dollar-pegged stablecoins.

This innovation preserves long-term XRP exposure while unlocking utility for payments, trading, and DeFi activities. Flare’s decentralized Time Series Oracle (FTSO) ensures real-time price feeds for collateral and stablecoins, maintaining market integrity.

A stability pool mechanism safeguards the peg, with participants earning rewards from fees and liquidations. The platform plans to expand collateral options to include stXRP, enabling yield-bearing assets to double as loan collateral.

Enosys Loans enhances the ecosystem with a multi-tiered incentive structure, blending risk management with borrower rewards. The development signals growing sophistication in leveraging dormant crypto assets for productive finance.

XRP ETF Launch Spurs 762% Surge in Exchange Inflows

XRP witnessed a seismic shift in market dynamics following the debut of its first U.S. exchange-traded fund (ETF) on September 18, 2025. Exchange inflows for the cryptocurrency exploded by 762% to 11.57 million XRP, up from just 1.34 million the previous day, according to CryptoQuant data.

Despite the influx—typically a precursor to selling pressure—XRP's price defied expectations by climbing over 5% on launch day. The divergence suggests robust demand absorbed speculative trading activity triggered by the ETF's introduction. Market analysts attribute the momentum to renewed institutional interest and investor repositioning.

The ETF milestone signals growing mainstream acceptance for XRP, though short-term volatility persists. Prices dipped into negative territory shortly after the initial surge, reflecting profit-taking behavior. Long-term prospects appear brighter, with the ETF structure expected to facilitate broader institutional participation in the XRP market.

XRP ETF Smashes Records on CBOE Debut Amid Bullish Market Sentiment

The launch of a spot exchange-traded fund (ETF) for XRP has ignited significant market activity, with the REX-Osprey XRP ETF (XRPR) attracting $24 million in volume within its first 90 minutes of trading. This robust institutional interest underscores growing confidence in Ripple's token, potentially reshaping altcoin momentum.

XRP's price action shows resilience despite hitting resistance at $3.15, with analysts eyeing a consolidation phase before retesting its 2018 all-time high of $3.84. A short-term pullback to $2.60 could serve as a springboard for upward movement, particularly if trading volumes surge. Breakout above $3.65 remains a key threshold for bullish continuation.

Analyst Warns XRP Holders To Be Prepared For Market Volatility

Crypto analyst Austin Hilton has issued a stark reminder to XRP investors: macroeconomic events like Federal Reserve rate decisions are secondary to disciplined portfolio management. The real focus, he argues, should be on constructing a resilient investment framework.

Hilton's prescription is methodical—know your position size, understand your cost basis, and establish clear profit-taking levels. "These metrics FORM the bedrock of rational decision-making," he emphasizes, noting that unprepared investors often capitulate during downturns while disciplined holders recognize market cycles.

XRP's journey through the crypto winter of 2022-2023 serves as a case study in perseverance. Though the asset faced extreme pressure, Hilton observes emerging signs of recovery. His warning carries particular weight as 2024's market structure appears bifurcated—showing both renewed institutional interest and persistent retail volatility.

Is XRP a good investment?

Based on current technical indicators and market developments, XRP presents a compelling investment opportunity for risk-tolerant investors. The cryptocurrency is trading at $2.9877, showing stability above its 20-day moving average while institutional momentum builds through ETF success and new financial products.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $2.9877 | Above 20-day MA support |

| 20-day MA | $2.9562 | Key support level |

| Bollinger Upper | $3.1738 | Near-term resistance |

| Bollinger Lower | $2.7386 | Strong support zone |

| MACD Signal | -0.0615 | Bearish but improving |

BTCC financial analyst Mia emphasizes that while technicals show consolidation, the fundamental backdrop of institutional adoption, ETF inflows, and analyst predictions reaching $30 by 2026 creates a favorable risk-reward scenario for long-term investors.